The IRS has outlined a general timeline for income tax refunds in 2026, giving taxpayers a clearer idea of when they may receive their money. With improved electronic filing systems and more efficient processing technology, many refunds are expected to arrive sooner than in previous years. Understanding how the schedule works can help households plan for bills, savings, and other financial needs.

How the IRS Refund Process Works

The IRS typically begins accepting 2025 tax returns in late January 2026. Once a return is filed, the processing speed depends on several factors:

- Filing method (electronic or paper)

- Accuracy of information provided

- Selected payment method (direct deposit or check)

- Whether the return requires additional verification

Electronic filing paired with direct deposit remains the fastest way to receive a refund, while paper returns or returns flagged for review may take longer.

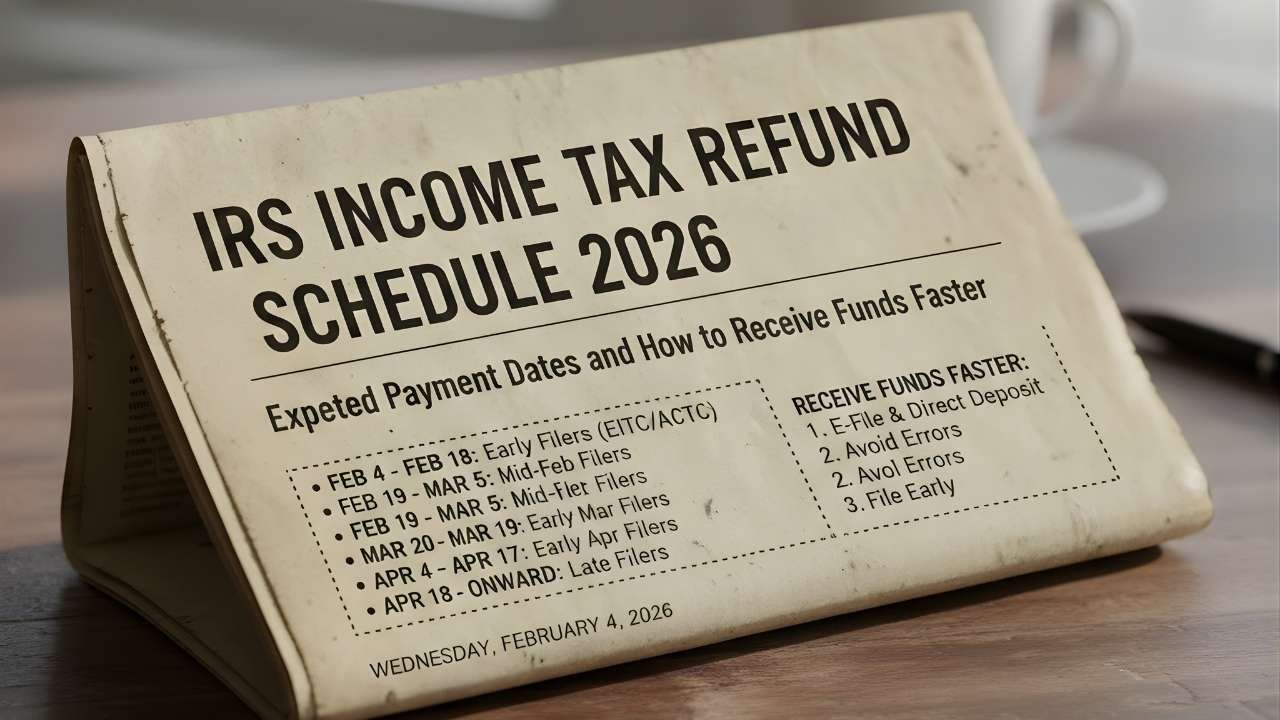

Expected Refund Timeline for 2026

Although exact dates vary by individual circumstances, taxpayers can generally expect the following:

- Early filers submitting in late January may see refunds by mid-February

- Returns filed in February are likely to arrive by late February or early March

- March filers can expect refunds within two to three weeks

- Paper returns typically require additional processing time

Tax returns claiming refundable credits such as the Earned Income Tax Credit or Additional Child Tax Credit may experience delays due to required verification.

Steps to Receive Your Refund Faster

The IRS recommends several best practices to minimize delays:

- File electronically rather than submitting paper returns

- Choose direct deposit for faster payment

- Ensure all personal and financial information is accurate

- Submit returns early in the tax season

Following these steps can significantly reduce processing times and help ensure refunds arrive as quickly as possible.

Reasons Refunds May Be Delayed

Some refunds take longer to process due to issues such as:

- Incorrect Social Security numbers or mismatched income reporting

- Missing forms or supporting documents

- Identity verification checks

- Returns claiming refundable tax credits

If your return is flagged for review, additional processing time may be required before payment is issued.

Tracking Your IRS Refund

Taxpayers can monitor the status of their refunds using IRS tools such as “Where’s My Refund?” To check your refund, you will need:

- Social Security number

- Filing status

- Exact refund amount

Updates are generally available within 24 hours of submitting an electronic return, allowing taxpayers to track progress and anticipate payment timing.

What the 2026 Refund Schedule Means for Taxpayers

The 2026 refund schedule reflects improvements in processing efficiency, particularly for electronic filers. Faster refunds can help households manage monthly bills, rebuild savings, or address unexpected expenses. Planning ahead and filing early remains the most reliable strategy for ensuring timely payment.

Conclusion

The IRS income tax refund schedule for 2026 provides taxpayers with a clearer understanding of when to expect payments. While individual circumstances can affect timing, most electronic filers can anticipate receiving refunds within a few weeks. Using direct deposit, filing early, and verifying information are key steps for a smooth refund experience.

Disclaimer

This article is intended for informational purposes only and does not constitute financial or tax advice. Refund timelines and amounts vary based on individual circumstances. Taxpayers should consult the official IRS website or a qualified tax professional for guidance specific to their situation.